For expatriates that qualify for tax residency Malaysia has a progressive personal income tax system in which the tax rate increases as an. Not only are the rates 2 lower for those who has a chargeable income between RM20000 and RM70000 the maximum tax rate for each income tier is also lower.

Navient Student Loan Settlement Who Qualifies For Relief And What To Do

2 Tax Relief for Purchase of breastfeeding equipment Limited to RM1000 3 Tax Relief for Childcare fees to a Child Care Centre or a Kindergarten Limited to RM1000 For the assessment year 2017 item 1 iv is a come back from the year 2010-2015.

. Personal tax relief Malaysia 2020. Where a person is paid more than one pension only the higher or highest. Pensions from an approved pension scheme pension derived from malaysia and paid by the government or to a person on reaching the age of 55 years or compulsory age of retirement under any written law or if the retirement is due to ill-health are exempt from tax.

Combining both taxable income and tax reliefs together the amount will arrive at. Income Tax Rate Malaysia 2018 vs 2017 For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. The conditions of entitlement for each relief must be satisfied in order to minimize the income tax liability.

1 A medical policy must satisfy the following criteria a the expenses should be related to the medical treatment resulting from a. 2018 Personal Tax Incentives Relief for Expatriate in Malaysia For expatriates working for Labuan International there is a special rebate where foreign directors income is zero tax and expatriate employees are subject to a 50 rebate in their earnings. Although we have passed the due date months ago this can be useful to prepare for the assessment year 2017.

The relief amount you file will be deducted from your income thus reducing your taxable income. Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the purpose to reduced the burden of tax payers. Chargeable income RM54000 Taxable Income RM9000 Individual Tax Relief RM5940 EPF contribution tax relief RM39060 Her chargeable income would fall.

So the estimated total amount of my personal tax relief for YA 2018 is RM2146085 RM1836085 The total tax relief is slightly less than my tax relief for the assessment year 2017 which was RM24335. Employees be eligible to claim relief up to a maximum of RM250 per year on the contribution to SOCSO. Other personal deductions reliefs The above are also available to a spouse who is separately assessed.

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. Make sure you keep all the receipts for the payments. 1RM 1000 tax relief for breastfeeding equipment claimable biennially from assessment Year 2017 2RM 1000 tax relief for those who enrolled their children aged 6 and below into registered nurseries and preschools from assessments Year 2017 For new parents this is really a good news.

Tax relief on study fees be increased from RM5000 to RM7000 per year. Then there are two good news on Childcare and they are. Item 2 and 3 are something new comparing to the assessment year before.

Payment of a monthly bill for internet subscription Smartphones The maximum income tax relief amount for the lifestyle category is RM2500. Mortgage interest incurred to finance the purchase of a house is deductible only if income is derived from the house. Tax rates in Malaysia.

Do also take note. The Malaysian 2020 budget raised the maximum tax rate an individual could pay to 30 percent from 28 percent for chargeable income exceeding 2 million ringgit US489 thousand. Resident individuals are eligible to claim the following tax rebates which are to be deducted from tax charged.

The difference was mainly due to I reduced my PRS contribution in 2018 compared to the year 2017. 4 S15A Income from Services Deemed Derived from Malaysia 9 5 New S461p Lifestyle Relief 11 6 New S461q Tax Relief for the Purchase of Breastfeeding Equipment 12 7 New S461r Tax Relief for Fees Paid to Child Care Centres and Kindergartens 12. Printed in Malaysia by SP-Muda Printing Services Sdn Bhd 906732-M 82 83 Jalan KIP 9 Taman Perindustrian KIP Kepong 52200 Kuala Lumpur.

This incentive available till the Year 2020. Every year the working Malaysians scramble to file their personal income tax by April. Individual - Other tax credits and incentives.

If husband and wife are separately assessed and the chargeable income of each does not exceed MYR 35000. PwC 20162017 Malaysian Tax Booklet PERSONAL INCOME TAX Tax residence status of individuals An individual is regarded as tax. What is tax relief.

The previous laptop books stationary and sports equipment tax relief is now grouped under lifestyle tax too. Relief Exemption Remission from stamp duty. Below is the list of tax relief items for resident individual for the assessment year 2019.

Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015. 24 rows The amount of tax relief 2017 is determined according to governments graduated scale. The government has added a lifestyle tax relief during the 2017 budget which now includes smartphones tablets and monthly internet subscription bills.

Personal Tax Reliefs in Malaysia Reliefs are available to an individual who is a tax resident in Malaysia in that particular YA to reduce the chargeable income and tax liability. Corporate Tax SMEs that incur expenditure on R. There is also a separate tax relief for lifestyle expenses for sport activities.

You dont have to submit them to IRB but make sure you keep them. This relief is applicable for Year Assessment 2013 and 2015 only. Any excess is not refundable.

The tax relief for year 2017 folder_open Tax Relief for Individual. Companies are not entitled to reliefs and rebates. If husband and wife are jointly assessed and the.

To qualify for this income tax relief the Malaysian insurance policy must be in your name the policy owner is the claimant. Tax relief in Malaysia is issued by the Inland Revenue Board of Malaysia IRBM. So if you bought a computer that costs more than that you can no longer include your gym membership internet subscription and others for income tax relief.

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Know How You Can Claim Relief Under Double Taxation

These Are The Personal Tax Reliefs You Can Claim In Malaysia

Personal Tax Reliefs In Malaysia

Typeface Portfolio Vol 3 I Chinese Chess On Behance Graphic Design Posters Typeface Portfolio

Stress Relief Supplements Market Report 2017 2030 2020 Edition

Personal Tax Reliefs In Malaysia

Pin On Ramadhan 2017 Allocation

Pin On Natural Home Remedies For Farts

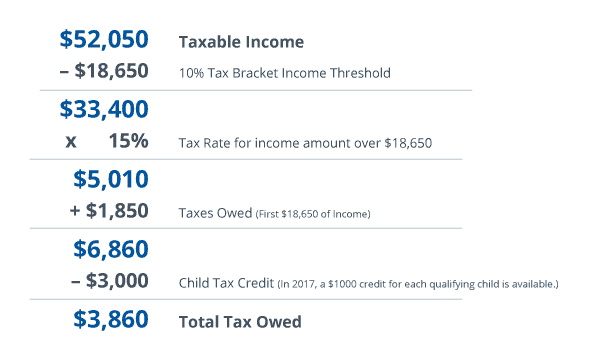

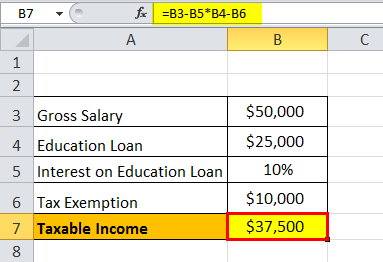

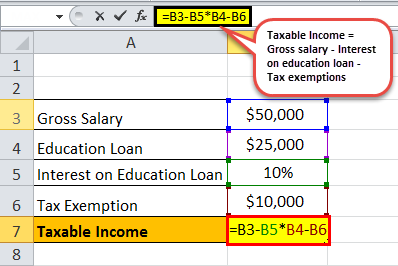

Taxable Income Formula Examples How To Calculate Taxable Income

Standard Deduction Tax Exemption And Deduction Taxact Blog

Taxable Income Formula Examples How To Calculate Taxable Income

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Taxable Income Formula Examples How To Calculate Taxable Income

Asean Deploys Terror Aid To Philippines Amid Marawi Crisis The Diplomat

到底几时要报税 2017年 Income Tax 更改事项 很多事项已经不一样 这些东西也可以扣税啦 Rojaklah Income Tax The Cure Relief

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust